Australia Post has recently made Country of Origin (COO), Goods Value, and HS Tariff Code mandatory for all international shipments. These requirements align with global customs regulations and are designed to ensure faster, smoother border clearance when sending parcels overseas.

Why These Fields Are Important

-

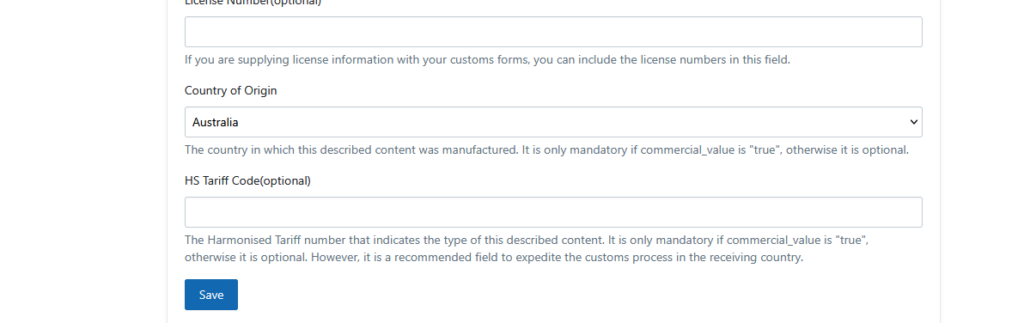

Country of Origin (COO): Customs authorities need to know where the product was manufactured. This affects import duties, taxes, and compliance with international trade laws.

-

Goods Value: Declaring the true commercial value of your goods is essential for customs to calculate duties and taxes. It also protects you against loss or damage claims.

-

HS Tariff Code: The Harmonized System (HS) code is a global classification system for goods. Providing the correct code ensures your items are categorised correctly at customs, avoiding delays and possible fines.

What This Means for You

From now on, you must include these three details when lodging international parcels with Australia Post. Without them, your shipments may be delayed, returned, or even refused entry at the destination country.

Different Product Types and origins.

If your business has different HS Tariff Codes and Country Of Origins we recommend you add these into your Shopify products. Adding them to your products ensures the correct HS Code is carried across to the order.

Common Product Type and Origin.

If you only sell one type of product or all products sold are from a single country of origin, to make this simple the Joovii app already includes dedicated fields for:

-

Country of Origin

-

Goods Value – Automatically added by App

-

HS Tariff Code

When you enter these details in your Joovii dashboard, they are automatically passed through to Australia Post with your shipment. This means:

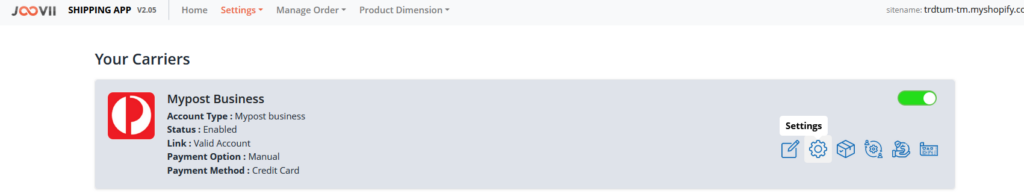

To add these details please go to the Joovii App >>>Settings >>>>Accounts >>>Settings (Cog)

Scroll down to the international section and provide the necessary details.

A list of HS Codes are available online HERE